Invoice a small Business Guide with just your smartphone.

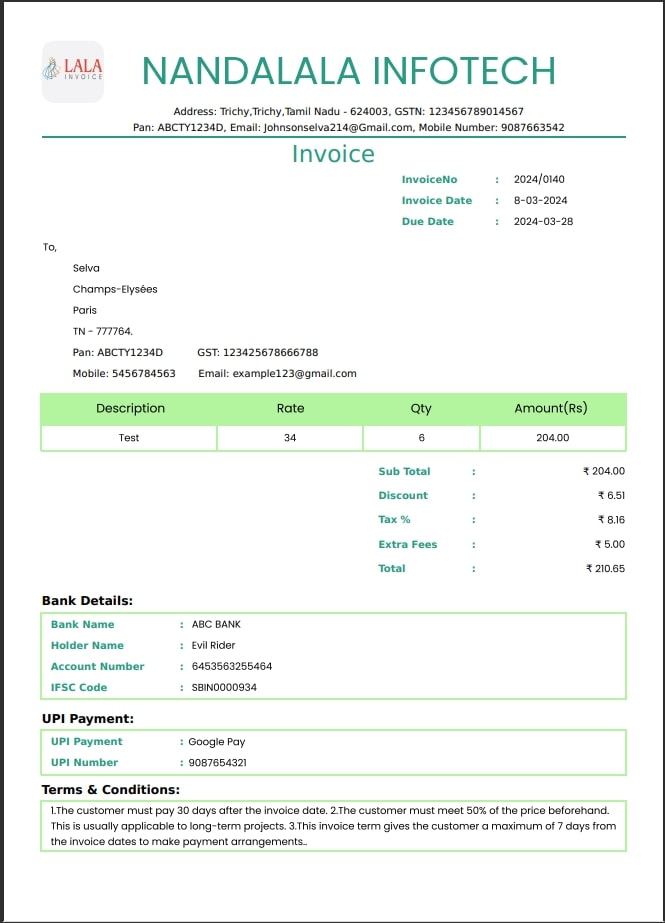

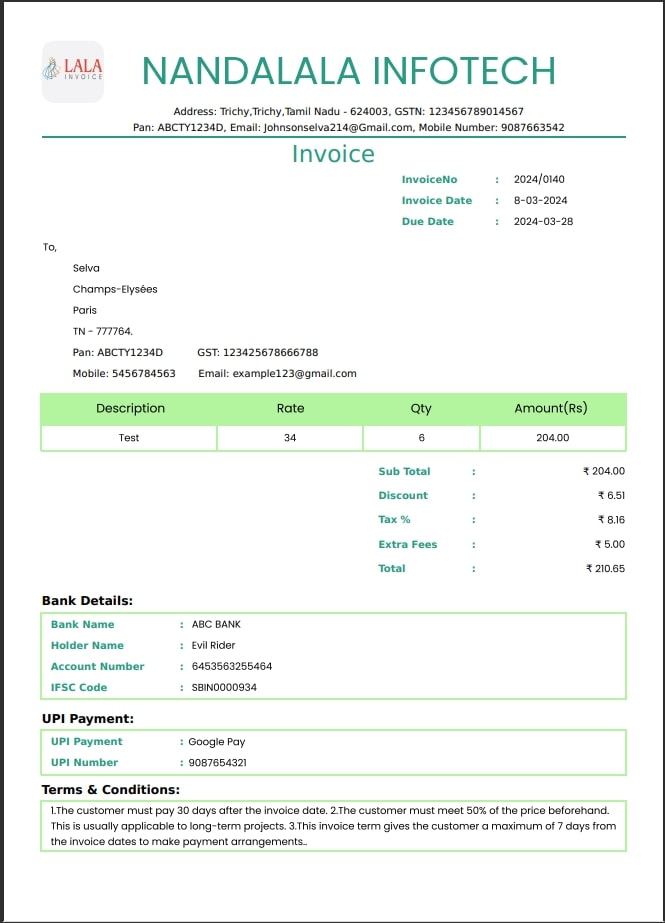

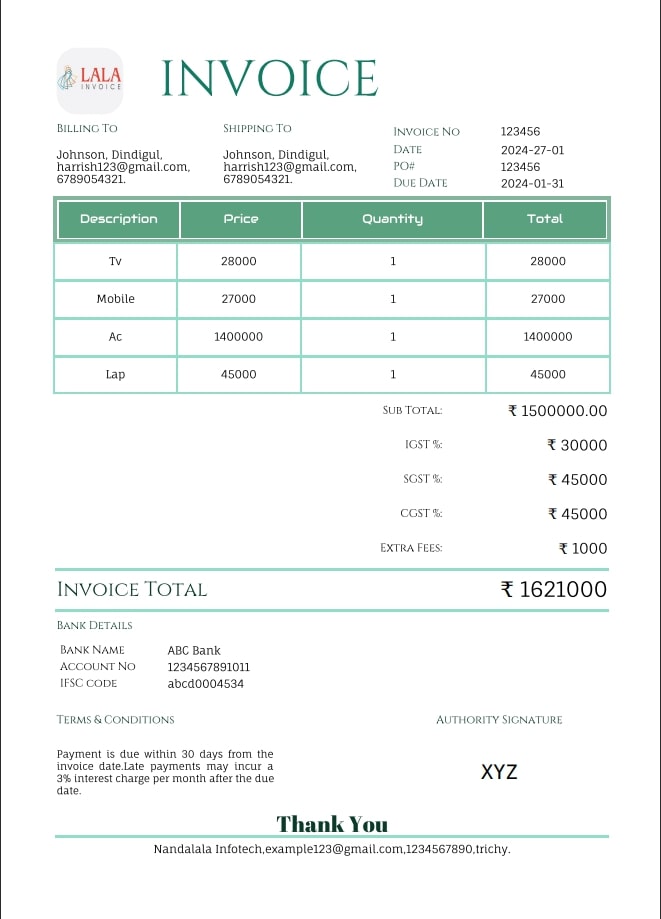

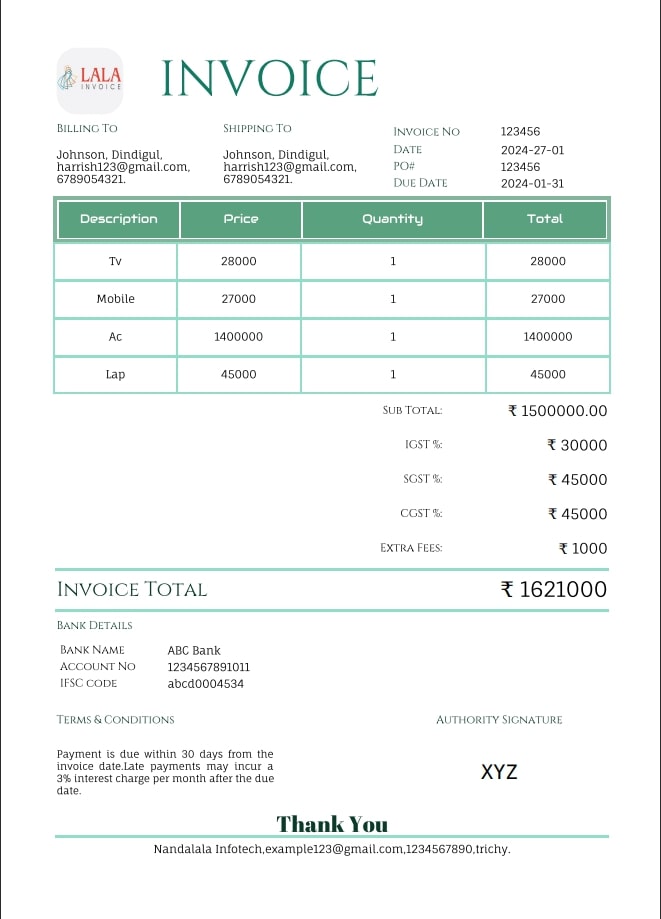

Create GST Invoice or Professional Invoice with Free Online Invoice Maker.

Unlimited GST Invoices.

You can Download, Print and Email Invoice.

You Can Share invoices whichever way youlike - SMS, Email, Telegram, WhatsApp.

A proforma invoice is a preliminary bill of sale sent to a buyer in advance of a shipment or delivery of goods or services. It outlines the items or services to be provided, their prices, and other relevant details such as terms of sale, payment terms, and delivery schedule. This document serves as a quotation or an estimate and is not considered a legally binding document like a commercial invoice. Instead, it helps the buyer to understand the cost and terms of the transaction before making a purchase decision.

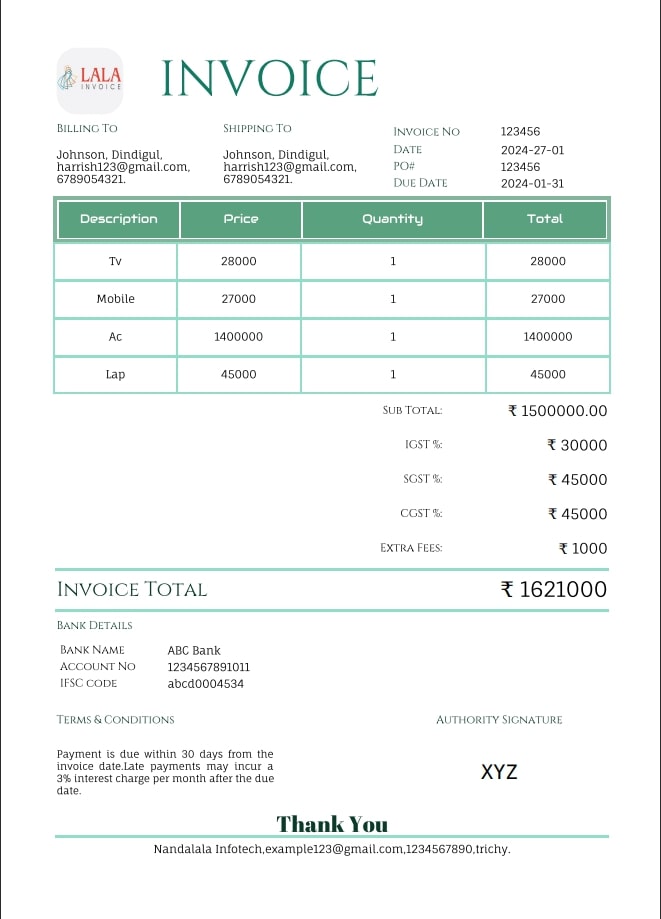

A commercial invoice is a document that serves as a formal request for payment for goods sold or services rendered between a seller and a buyer in a commercial transaction. It provides a detailed breakdown of the transaction, including information about the goods or services, their quantity, unit prices, total costs, payment terms, and any applicable taxes or fees. In international trade, commercial invoices play a crucial role in customs clearance and compliance with import/export regulations.

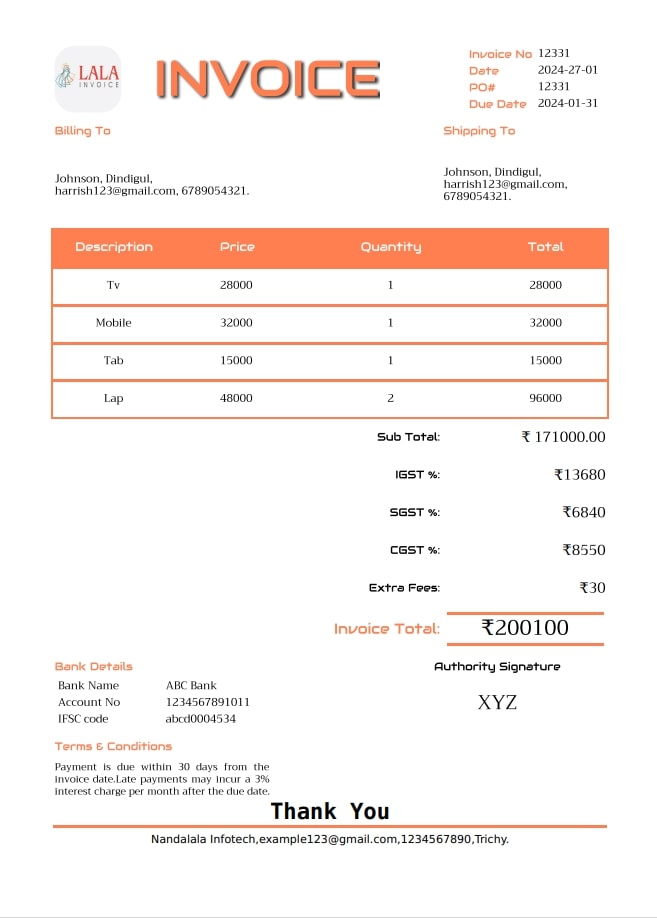

A sales invoice is a document issued by a seller to a buyer to request payment for goods sold or services rendered. It serves as a formal record of the transaction and outlines the details of the sale, including the description of the goods or services, payment terms, and any applicable taxes or fees. Sales invoices are typically generated after the completion of a sale or the provision of services, and they serve as proof of the agreement between the buyer and seller.It serves as a formal record of the transaction

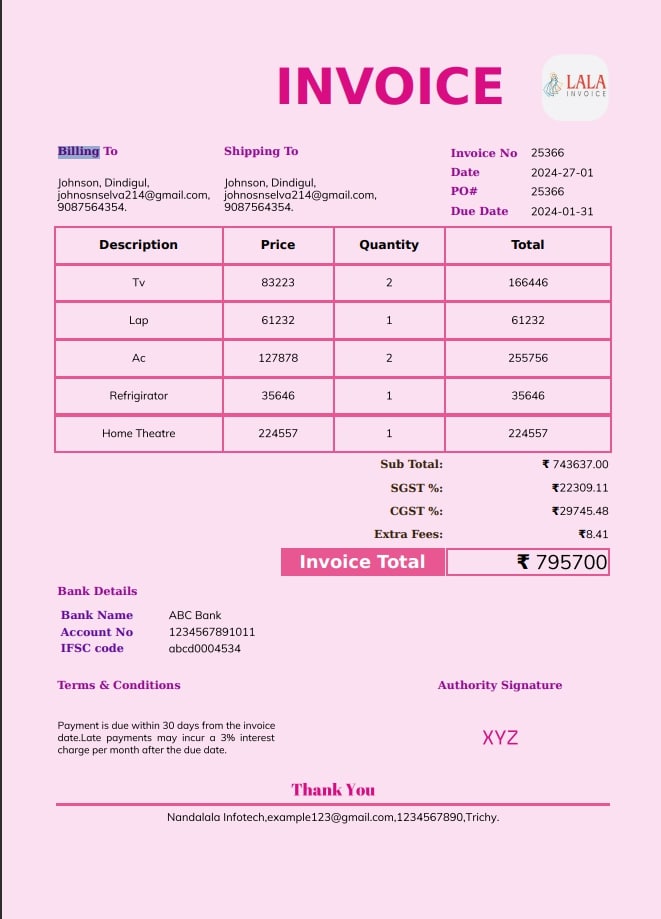

A blank invoice is a customizable document used by businesses to bill clients for goods or services provided businesses. It typically includes fields such as the seller's contact information, client details, a description of the products or services rendered, quantities, prices, total amounts due, and payment terms. Blank invoices allow for flexibility in tailoring the billing information to specific transactions and can be used across various industries and business models.

A medical invoice is a document provided by healthcare providers to patients or their insurance companies detailing the costs associated with medical services rendered. It serves as a formal request for payment and includes information such as the date of service, descriptions of medical procedures or treatments performed, the fees charged for each service, any applicable taxes, and the total amount owed.They serve as a record of medical expenses.

Jim & Fitness Invoice" is a billing document issued by a fitness center or personal trainer named Jim & Fitness to their clients. It includes details of services provided, such as fitness training sessions, gym memberships, or other related services. The invoice typically itemizes the fees for each service, any applicable taxes, and payment terms. It serves as a record of the financial transaction between Jim & Fitness and its clients. it's serve as a record of the services and products.

A supermarket invoice is a document issued by a supermarket to a customer detailing the products purchased, quantities, prices, and total amount owed. It typically includes information such as the date of purchase, store details, and payment terms. The invoice serves as a record of the transaction for both the supermarket and the customer and is often used for accounting and reconciliation purposes.

A textiles invoice is a document provided by a textile manufacturer, retailer to a customer who purchases textile products. It includes details such as the description of the textiles, quantities purchased, unit prices, total cost, and any applicable taxes or discounts. The invoice serves as a formal request for payment and provides a record of the transaction for both parties.Textiles invoices serve as a formal record of the transaction.

A teaching invoice is a document issued by a teacher or educational institution to a student or their guardian, detailing the services provided, such as tutoring sessions, classes, or educational materials, along with the associated fees and payment terms. It serves as a formal record of the transaction and helps to ensure timely payment for educational services rendered.They are essential for maintaining accurate records.

Easy to use I’m dyslexic. So I will let you know how it goes hopefully it won’t sting with huge price like most things to good to be true.

It means a lot to us.

"Delivers a very neat clean and professional looking invoice to the customers."

Yazhini Sivakumar - Managing Dırector

Pre-designed formats for creating professional invoices efficiently, tailored to various business needs and styles!

A proforma invoice is a preliminary bill of sale issued by a seller to a buyer before the completion of a transaction. It outlines the details of the goods or services to be provided, including descriptions, quantities, prices, and terms of sale. Unlike a commercial invoice, a proforma invoice is not a legally binding document but serves as a quotation or an estimate of costs. It allows the buyer to review and confirm the details of the transaction before finalizing the purchase.Proforma invoices are commonly used in international trade to facilitate negotiations, customs clearance, and secure financing or letters of credit.

A sales invoice is a document issued by a seller to a buyer, requesting payment for goods or services provided. It includes details such as the description of items sold, quantities, prices, payment terms, and total amount due. Sales invoices serve as formal records of transactions and are essential for accounting, tax purposes, and tracking sales revenue. They provide both parties with documentation of the agreement and facilitate smooth financial transactions.

A tax invoice is a document issued by a seller to a buyer, detailing the sale of goods or services and including the applicable taxes. It typically includes information such as the seller's and buyer's names, addresses, invoice number, date, descriptions of the goods or services provided, quantities, prices, and the total amount due including taxes. Tax invoices are crucial for accounting and tax compliance purposes, providing evidence of taxable transactions and enabling the claiming of input tax credits or deductions. They serve as legal records of transactions and are required by tax authorities for audit purposes.

A Teaching invoice is a document issued by an educator or teaching professional to a student or their guardian, requesting payment for educational services provided. It includes details such as the instructor's name, contact information, services rendered (e.g., tutoring sessions, classes), dates of service, hourly rates or package fees, and the total amount due. Teaching invoices are essential for tracking income, managing finances, and maintaining records of services rendered. They serve as formal requests for payment and facilitate transparent financial transactions between educators and students.

A document issued by Jim & Fitness to clients, detailing services provided such as personal training sessions, gym memberships, or fitness classes. It includes information like client details, service descriptions, session dates, rates, and the total amount due for payment. This invoice serves as a formal request for payment and aids in managing client accounts and financial transactions for fitness-related services.

A document issued by a supermarket to customers, itemizing purchased goods and their prices. It includes details like the date of purchase, item descriptions, quantities, prices, any applicable taxes, and the total amount due. This invoice serves as a record of the transaction and provides customers with a breakdown of their purchases for payment reference.

A document issued by a supermarket to customers, itemizing purchased goods and their prices. It includes details like the date of purchase, item descriptions, quantities, prices, any applicable taxes, and the total amount due. This invoice serves as a record of the transaction and provides customers with a breakdown of their purchases for payment reference.

A document issued by a supermarket to customers, itemizing purchased goods and their prices. It includes details like the date of purchase, item descriptions, quantities, prices, any applicable taxes, and the total amount due. This invoice serves as a record of the transaction and provides customers with a breakdown of their purchases for payment reference.

A document issued by a supermarket to customers, itemizing purchased goods and their prices. It includes details like the date of purchase, item descriptions, quantities, prices, any applicable taxes, and the total amount due. This invoice serves as a record of the transaction and provides customers with a breakdown of their purchases for payment reference.

An invoice is a document issued by a seller to a buyer indicating the products, quantities, and agreed-upon prices for products or services the seller has provided. In essence, it is a bill that specifies the amount the buyer owes to the seller for the goods or services received. In addition to itemizing the products or services provided, an invoice typically includes other details such as payment terms, due date, any applicable taxes or discounts, and the seller's contact information. In business transactions, invoices serve as a crucial record of the transaction and are used for accounting, payment processing, and tracking purposes.

An invoice serves as a formal request for payment, documenting the transaction between the buyer and the seller.It helps maintain a record of sales and provides a basis for financial reporting and taxation.

An invoice should include: seller and buyer details, invoice number and date, description of goods/services, quantity, unit price, total amount due, payment terms, and any applicable taxes or discounts.

You can track payments on your invoices by using accounting software, spreadsheets, or manual record-keeping methods to log payments received against each invoice..

Payment terms specify when the payment is due. Common terms include "Net 30" (payment is due 30 days after the invoice date), "Due on Receipt" (payment is due immediately), and others depending on the agreement between the buyer and seller.

Yes, you can customize an invoice template to suit your needs by adding your logo, company information, payment terms, and any other relevant details.

Yes, electronic invoices are legally accepted in many jurisdictions. They are often more efficient and environmentally friendly than traditional paper invoices. However, it's essential to comply with relevant regulations and ensure the recipient accepts electronic invoices.

If a customer doesn't pay on time, you should send a polite reminder, followed by a formal letter requesting payment. If the issue persists, consider contacting the customer directly or seeking legal advice.

To create an electronic invoice, use accounting software or online invoicing tools to input your business and client information, itemize products or services provided, add payment terms, and generate a digital invoice for emailing or online delivery.

To generate an e-Invoice for services, use online invoicing software or platforms. Input service details, pricing, and client information, then generate and send the invoice electronically via email or through the software's portal.

All the user visiting the website can contact us any any time by sending their message

We will do our best to solve your queries

"My overall experience with LaLa Invoice was that it was a breeze to use."

Prasanna Ram - Creative Dırector